Our founding team of supply chain veterans and ML experts has created one of the most sophisticated suites of optimization tools in the supply chain world. Let us show you.

by Tom Moore on Apr 25, 2023 9:20:00 AM

Knight/Swift projections after reporting a big drop in profits for Q1:• Continued softness in freight demand with non-contract rates trending below contract rates through the first half of 2023

• Capacity continues to exit at an accelerating rate

• Freight volumes begin to improve during Q3

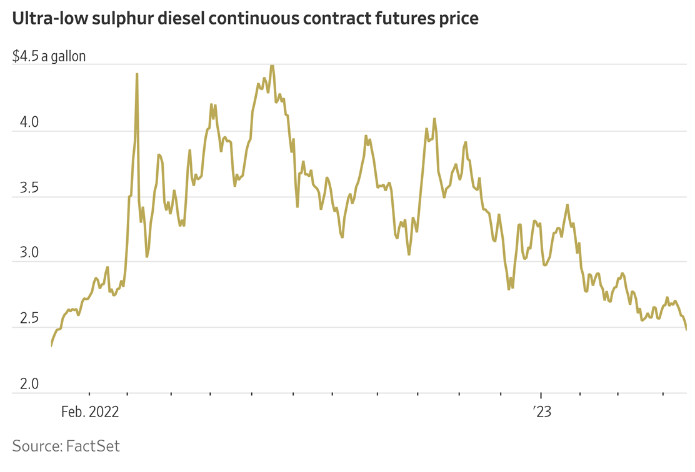

• Spot pricing bottoms out in Q2 and begins recovering in 2nd half of 2023

• Expect trailer pool service to continue to be a differentiator when demand recovers

• LTL demand pressured but remains more stable than truckload

• LTL improvement in revenue (excluding fuel) per hundredweight year-over-year

• Inflationary pressures ease in many cost areas but remain elevated on a year-over-year basis

• Equipment and labor availability continues to improve, particularly for large carriers

• Demand in the used equipment market weakens as small carriers struggle.

Diesel: Improving trends (Not necessarily reflected in the street prices)

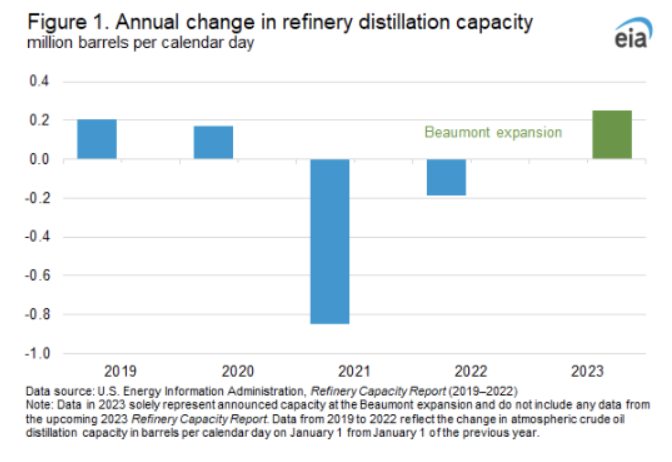

Exxon refinery expansion: $2 billion project increases capacity for transportation fuels by 250,000 barrels per day. While it is not enough to make up for 2021 + 2022 closures, it is a step in the right direction.

Our founding team of supply chain veterans and ML experts has created one of the most sophisticated suites of optimization tools in the supply chain world. Let us show you.

© ProvisionAi All rights reserved. 2024